Turnover up to eight times higher than during shutdown

Germany’s retailers are currently working their way out of the shutdown step by step and at different speeds, each depending on the specific reopening date in their respective federal state. In this exclusive analysis for Börsenblatt, the market researchers at Media Control have gathered the latest data on book-industry turnover to examine the progress being made by bricks-and-mortarbookshops and the extent to which their efforts are reflected in sales figures.

For the purposes of this analysis, the week from 10 to 16 February 2020 (week 7) was chosen as a reference value depicting an average week in terms of turnover in an otherwise typical year. Week 7 is then compared to the week from 20 to 26 April 2020 (week 17), which marked the first week during which bookstores were permitted to re-open for business in all federal states, with the exception of Bavaria and Thuringia.

Some federal states showing better figures than before Corona

A comparison of the sales figures in week 7 and week 17 permits cautious optimism. On the whole, in week 17, booksellers across Germany achieved an average of 81.5 percent of the turnover levels they enjoyed during week 7. What’s more, these numbers do not take into account online book sales which, according to many booksellers, have increased considerablydue to store closures.In addition, overall levels of customer footfall and desire to buy books are far from where they used to be – and from where we want them.

In some federal states, bricks-and-mortar bookshopswere even able to improve ontheir week 7 revenues after re-opening in week17. The top performer was Lower Saxony, which saw an increase of 10.9 percent. A possible explanation for this uptick is that the shutdown generated new customers who then flocked to bookstores after the lockdown; another explanation could be that when customers finally had the opportunity to browse in bookstores again, this led to impulse buying and multiple purchases.

In the state of North Rhine-Westphalia, revenues in week 17 were also greater than in week 7 –by roughly eight percent. In contrast, booksellers in Berlin, where bookshops remained open throughout the lockdown, experienced no noticeable upswing in week 17, hovering at levels equivalent to 54.4 percent of those in week 7.

As expected, the lowest performers in this context were the federal states of Bavaria and Thuringia, where bookstores remained shuttered during week 17and book sales in that weekcame in at only 20.7 percent and 41.9 percent of the figures from week 7, respectively (sales to consumers by invoicewere included in thesefigures, as during the shutdown).

Open stores mean sales

This statement might seem all too obvious, but Media Control nevertheless decided to take a closer look at the numbers, delivering ananalysis of sales at local bookshops in each of Germany’s federal states in the first post-lockdown week as compared to the final week of the shutdown.

The biggest winner is the state of Bremen, where turnover was more than eight times higher in the first post-lockdown week (week 17) as compared to the final week of the shutdown (week 16). Mecklenburg-Western Pomerania reported an almost six-fold increase in sales. Germany’s larger federal states have also done well in week 17: for example, North Rhine-Westphalia saw revenues increase by 221 percent and thus more than three times the sales of week 16. Baden-Württemberg generated 2.5 times the volume of book sales as in the previous week, and Lower Saxony was able to increase its revenues by a factor of 2.7. Taken together, all of Germany’s federal states achieved a 2.6-fold increase between week 16 and week 17.

Lower profit for all

A quick glance at developments in all distribution channels taken together and their comparative performance in weeks16 and 17 reveals thaton average, revenues across all federal states were 1.5 times greater in week 17 than in week 16. Here, once again, Bremen came in at the top of the scale with a fivefold increase in revenues, followed by Saarland with an almost fourfold boost. Booksellers in North Rhine-Westphalia fared pretty well with revenues that more than doubled,as they did in Lower Saxony.

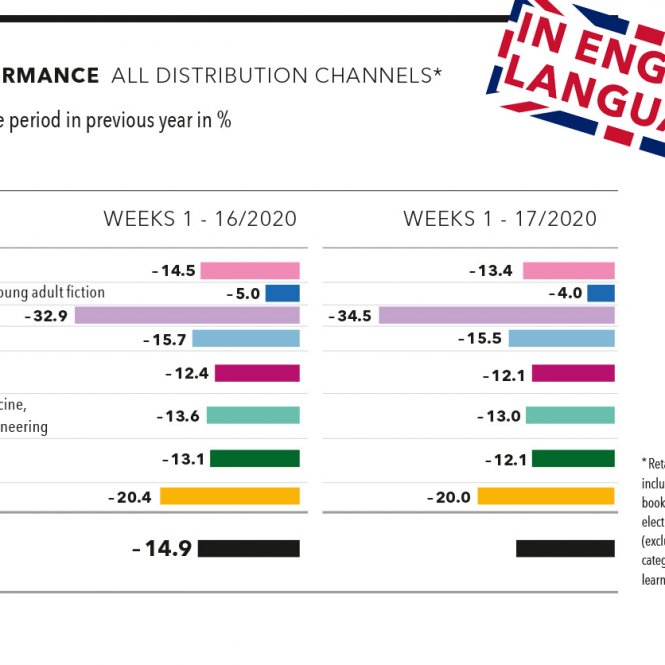

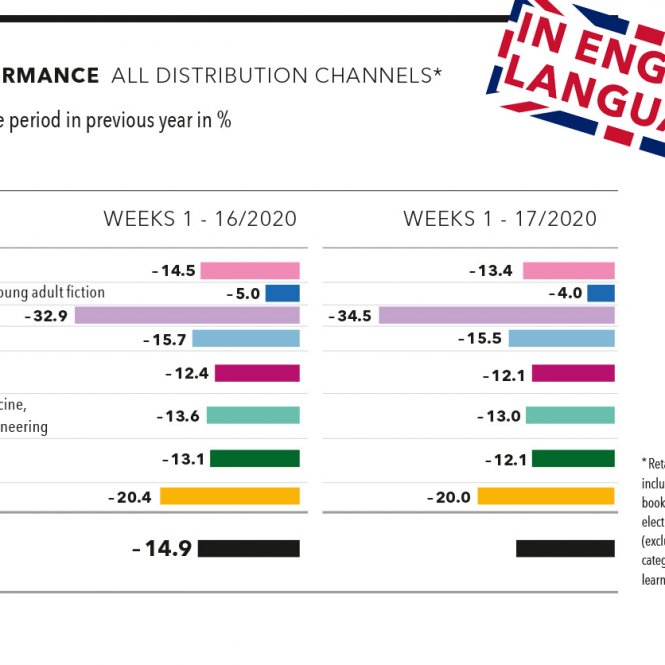

And now for some more comparisons: this time, an evaluation of book industry turnover in weeks 1 to 16 compared to weeks 1 to 17, with a focus on product categories and sub-categories. If we take all distribution channels together, the figures show that the shortfall in sales accrued from the beginning of the year until week 16 is alleviated slightly thanks to week 17. Indeed, while the drop in sales across all product categories up to and including week 16 was 14.9 percent compared to the same time period the previous year, that number was half a percentage point lower (14.4 percent)after the end of week 17 (see chart above).

For example, at the end of week 17, the fiction category came in at 13.4 percent below the figure for the corresponding period in the previous year, meaning that week 17 was able to narrow the gap displayed in the previous week’s figure (14.5 percent) by 1.1 percentage points. Children’s books and young adult fiction have also started to catch up and are now only four percent away from the previous year’s figures.

The travel category has the most catching-up to do, with sales between weeks 1 and 17 collapsing by 34.5 percent; in fact, this number was even 1.6 percentage points worse in the following week than between weeks 1 and 16. There appears to be a considerable degree of uncertainty among consumers as to how and whether they will be able to travel in the coming months. The category of non-fiction books was also not able to match the success of the previous year and remained almost unchanged with a drop of 20 percent.

On the positive side, sales figures in the weeks 1 - 17 period also reveal that certain product categoriesare benefitting from the crisis;first and foremost children’s books and young adult fiction. In the sub-category of “playing and learning”, the figures show an increase of 11.9 percent year on year. The sub-category of “early childhood and pre-school books” is slowly working its way back with a 0.3 percent rise.

There are also positive signals for the “humanities, art and music” product category; sales of books in the humanities in general saw an increase of 4.9 percent, whereby philosophy managed a rise of 3.5 percent.

The sub-category of “playing and learning” enjoyed an 11.9 percent increase across all distribution channels in weeks 1 to 17, making it one of the clear beneficiaries of the crisis.

In the first post-lockdown week (week 17), bricks-and-mortar bookstores in Bremen generated 8 times the sales they had achieved in the final week of the shutdown (week 16).

Overall, the shortfall in sales accrued for the entire book trade between weeks 1 and 17 amounts to 14.4 percent.

Because developments in book sales are particularly dynamic and uncertain at this time, Media Control and Börsenblatt will be publishing more facts and figures than usual over the coming weeks. For example, each week, we will be issuing a comparison of sales over the previous week in all distribution channels combined, and on bricks-and mortar bookshops separately. We will also be providing cumulative values per week as well as a one-off evaluation for each day from 1 March to 2 May 2020 for the overall market and bricks-and-mortar bookshops.