A long way to go

Normal 0 21 false false false DE X-NONE X-NONE /* Style Definitions */ table.MsoNormalTable {mso-style-name:"Normale Tabelle"; mso-tstyle-rowband-size:0; mso-tstyle-colband-size:0; mso-style-noshow:yes; mso-style-priority:99; mso-style-parent:""; mso-padding-alt:0cm 5.4pt 0cm 5.4pt; mso-para-margin-top:0cm; mso-para-margin-right:0cm; mso-para-margin-bottom:10.0pt; mso-para-margin-left:0cm; line-height:115%; mso-pagination:widow-orphan; font-size:12.0pt; font-family:"Arial",sans-serif; mso-fareast-language:EN-US;}

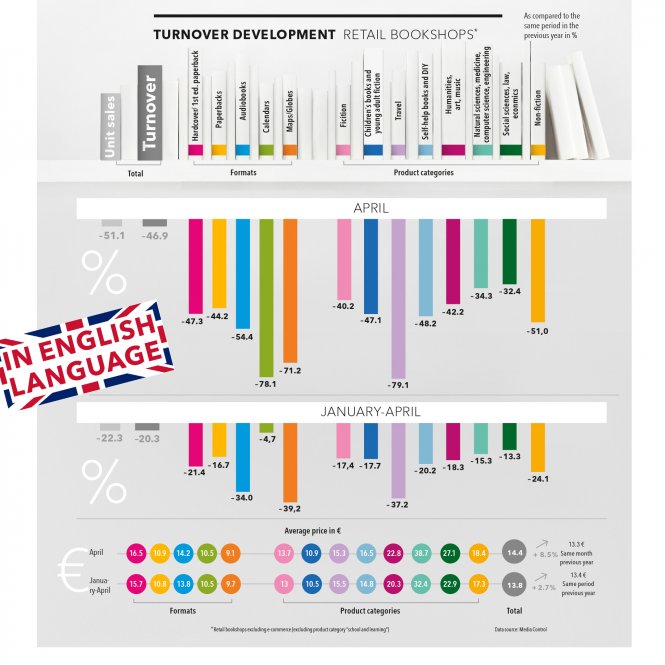

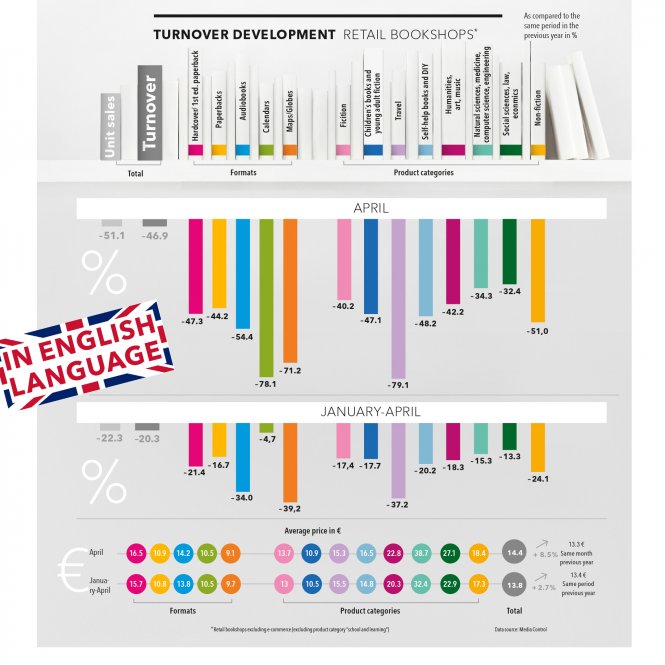

The coronavirus lockdown in March/April 2020 is already destined to go down in the history books of retail. And now, Media Control’s latest book-industry report (Branchen-Monitor Buch) for the month of April has provided concrete figures testifying to the full impact on book-industry turnover. Stores were prohibited from opening until the 20th of the month (or later), and this shutdown cost local booksellers roughly half their revenues as compared to the same month the previous year, a drop of 46.9 percent (see chart).

In April, turnover in hardcover and first-edition paperbacks at retail bookshops fell by 47.3 percent, with paperbacks dropping by 44.2 percent. In terms of individual product categories, travel recorded the highest drop at almost 80 percent, followed by a 51 percent hit for non-fiction books. A glance at overall unit sales shows a decline of 51.1 percent, while prices rose by an impressive 8.5 percent.

If we take all distribution channels together, however, the drop is slightly less severe at 33 percent. Unit sales fell by 33.9 percent alongside a minor price increase of only 1.4 percent. Hardcover and first-edition paperbacks lost 33.9 percent of value year-on-year, compared to a 28.3 percent loss for paperbacks.

Figures across all distribution channels in individual product categories were also in the red, whereby children’s books and young adult literature achieved the best result with a drop of only 19.6 percent, with fiction titles falling 28.8 compared to the previous year. Once again, the biggest losers were travel books, which lost more than three quarters of their usual turnover.

Normal 0 21 false false false DE X-NONE X-NONE /* Style Definitions */ table.MsoNormalTable {mso-style-name:"Normale Tabelle"; mso-tstyle-rowband-size:0; mso-tstyle-colband-size:0; mso-style-noshow:yes; mso-style-priority:99; mso-style-parent:""; mso-padding-alt:0cm 5.4pt 0cm 5.4pt; mso-para-margin-top:0cm; mso-para-margin-right:0cm; mso-para-margin-bottom:10.0pt; mso-para-margin-left:0cm; line-height:115%; mso-pagination:widow-orphan; font-size:12.0pt; font-family:"Arial",sans-serif; mso-fareast-language:EN-US;}

The book trade returns

Two charts available exclusively to Börsenblatt (see above) show the relative development in turnover prior to and after the shutdown. Shortly before most bookshops were forced to close on 18 March, revenues in retail stores as well as in all other distribution channels were up thanks to “panic buying”.

After that, developments took a different course in each category: in the entire book trade as a whole, turnover roughly halved, whereby bricks-and-mortar bookshops came in at only 30 percent of their erstwhile turnover.

Upon further examination, however, one can see that the curve is working its way back up – bit by bit and with small setbacks. For example, on 2 May, turnover reached the level of 2 March. This holds true if we view all distribution channels taken together. Of course, the re-opening of bricks-and-mortar bookshops also had a clear impact on sales figures, prompting a strong boost in turnover by a factor of 2.5. Indeed, all distribution channels together managed to almost double their turnover.

Normal 0 21 false false false DE X-NONE X-NONE /* Style Definitions */ table.MsoNormalTable {mso-style-name:"Normale Tabelle"; mso-tstyle-rowband-size:0; mso-tstyle-colband-size:0; mso-style-noshow:yes; mso-style-priority:99; mso-style-parent:""; mso-padding-alt:0cm 5.4pt 0cm 5.4pt; mso-para-margin-top:0cm; mso-para-margin-right:0cm; mso-para-margin-bottom:10.0pt; mso-para-margin-left:0cm; line-height:115%; mso-pagination:widow-orphan; font-size:12.0pt; font-family:"Arial",sans-serif; mso-fareast-language:EN-US;}

No beneficiaries of the crisis

Sales through other retail outlets represent a special case, as many stores were able to remain open during the lockdown, thus prompting a number of customers to purchase books there, seeing as bricks-and-mortar bookshops were shuttered. Grocery stores, drugstores and similar points of sale experienced a considerable peak on and around the Easter holidays. Prior to and after that, however, turnover has gone up and down with the regular fluctuations and at the usual levels. In other words, so far, book sales through this channel have not been able to record a sustainable and lasting upswing out of the Corona crisis.

Normal 0 21 false false false DE X-NONE X-NONE /* Style Definitions */ table.MsoNormalTable {mso-style-name:"Normale Tabelle"; mso-tstyle-rowband-size:0; mso-tstyle-colband-size:0; mso-style-noshow:yes; mso-style-priority:99; mso-style-parent:""; mso-padding-alt:0cm 5.4pt 0cm 5.4pt; mso-para-margin-top:0cm; mso-para-margin-right:0cm; mso-para-margin-bottom:10.0pt; mso-para-margin-left:0cm; line-height:115%; mso-pagination:widow-orphan; font-size:12.0pt; font-family:"Arial",sans-serif; mso-fareast-language:EN-US;}

A look at week 18

A separate analysis of week 18 (including the nation-wide 1 May holiday in Germany) is worthwhile. This was the week in which bookshops in Bavaria and Thuringia were finally permitted to re-open their doors to customers. The bottom line is that in week 18, bookshops across Germany came up 19.2 percent short of the revenues they generated in the same week of the previous year. Roughly 9.4 percent less turnover was generated with fiction books, while children’s books and young adult fiction dropped by 13.8 percent. No product category recorded growth. There was a 22 percent drop in copies sold, though this was offset somewhat by the 3.7 percent increase in prices.

An analysis of all sales channels together provides somewhat more encouraging figures: in comparison to the same week the previous year, revenues were down 15.9 percent. In the realm of fiction, that number was 8.1 percent, and the category of children’s books and young adult fiction even saw an increase of 1.5 percent! In other words, the considerable demand for books for children and young adults – most of whom are still not back at school – continues. Prices remained at the previous year’s level, increasing only slightly by 0.1 percent. The number of copies sold dropped by 15.9 percent.

Why don’t the figures look better, especially considering that bookstores throughout Germany had re-opened? The following three points may help answer this question:

It should be noted that week 18 lacked one business day due to the May Day national holiday on the Friday, which makes it extremely likely that the figures would otherwise have been more positive, at least compared to the preceding week. However, this has no influence on comparisons to the previous year, because May Day was also celebrated during week 18 that year (on the Wednesday).

Normal 0 21 false false false DE X-NONE X-NONE /* Style Definitions */ table.MsoNormalTable {mso-style-name:"Normale Tabelle"; mso-tstyle-rowband-size:0; mso-tstyle-colband-size:0; mso-style-noshow:yes; mso-style-priority:99; mso-style-parent:""; mso-padding-alt:0cm 5.4pt 0cm 5.4pt; mso-para-margin-top:0cm; mso-para-margin-right:0cm; mso-para-margin-bottom:10.0pt; mso-para-margin-left:0cm; line-height:115%; mso-pagination:widow-orphan; font-size:12.0pt; font-family:"Arial",sans-serif; mso-fareast-language:EN-US;}

A comparison of weeks 17 and 18

Is the book trade in Germany going to be able to close the gap in turnover? And if so, how soon? The answer to this question can be found in a comparison of weeks 1 to 17 and weeks 1 to 18 (see charts, left). The balance across all distribution channels remained the same from week 17 to week 18: the loss accrued from January through week 18 (including 1 May) was still at 14.4 percent. Children’s books and young adult literature launched a mini-comeback and were able to move up from minus four percent to minus 3.6 percent.

We see a similar picture in bricks-and-mortar bookshops, where on balance, the drop in turnover was still at 20.4 percent. Fiction experienced a small uptick and was able to reduce its shortfall from 18.1 percent to 17.7 percent. A small ray of hope can be found in the increase in prices, which moved upwards from 2.6 percent to 2.7 percent.

All these figures point to the fact that the book sector has a long, hard road ahead as it seeks to offset the losses incurred during the corona shutdown.